Taxes are fees collected by the government to fund public services like healthcare, education, and infrastructure. If you’re running a small business in New Zealand, you’ll have taxation responsibilities. These include filing taxes for small businesses on your income, the goods and services you sell, and any employees you hire.

In this guide, we’ll reveal how to file tax returns nz, offering clear directions and expert advice every step of the way.

Importance of Filing Taxes Correctly

Filing your taxes accurately and on time is crucial for your business. It ensures you comply with the law and avoid penalties or fines. Proper tax filing also helps you understand your business’s financial health and can even lead to tax deductions or credits that save you money.

Understanding Your Tax Obligations

As a small business owner in New Zealand, you’ll encounter several types of taxes. These may include payroll taxes for small businesses, goods and services tax (GST), small business taxation, and possibly other taxes depending on your business activities.

Tax Rates and Thresholds

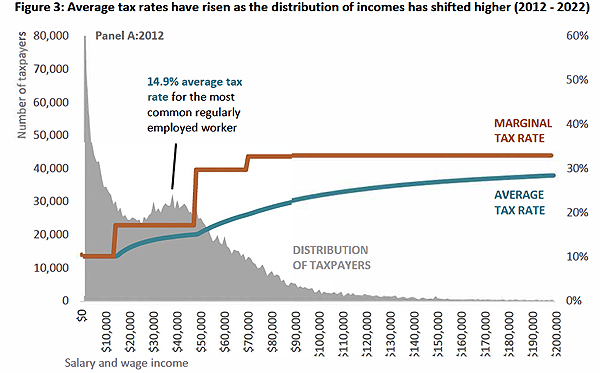

Tax rates refer to the percentage of your income or sales that you must pay in taxes. In New Zealand, income tax rates vary depending on how much money your business earns. Similarly, the small business tax rate nz is charged at a standard rate of 15% on most goods and services sold in the country. Also, here is the graph reflecting the different tax rates, number of taxpayers, and distribution of taxpayers between 2011-2022, I refer you to the Interest’s detailed article for better insights.

It’s essential to understand these rates and thresholds to calculate your tax obligations correctly. You can learn more with our guide on tax instructions for taxpayers.

Different Business Structures and Tax Implications

The way you structure your business can affect how much tax you pay. Common business structures in New Zealand include sole traders, partnerships, and companies. Tax deadlines can sneak up on even the most organized business owners. In New Zealand, the financial year doesn’t follow the usual January to December pattern. Instead, it spans from April 1st to March 31st of the following year.

Provisional Tax Obligations:

Provisional tax alleviates the burden of a substantial tax bill at year-end by allowing businesses to pay their tax liability in advance. If your tax bill exceeds $5,000, you’re required to pay provisional tax. This tax is payable in three installments: August 28th, January 15th, and May 7th of the following year.

Filing Requirements for Small Businesses:

Regardless of profit or revenue, all Small businesses must file an annual income tax return. Even if your business experienced no transactions or taxable activities, a ‘nil return’ is necessary. In case of a deficit or loss, it can be claimed and carried forward to offset against future profits, reducing your tax liability.

Tax Refunds and Business Losses:

Business losses are carried forward to future tax periods and offset against future profits. However, provisional tax may be refunded if the amount paid exceeds the actual income tax due, providing relief to eligible businesses.

Navigating the Filing Process:

Filing your annual Companies Income Tax Return (IR4) requires attention to detail. Utilizing the IRD’s secure online services via myIR streamlines the process, ensuring efficiency and accuracy. For sole traders, the Individual Income Tax Return (IR3) is the appropriate form. Seeking assistance from a qualified accountant can simplify the process and ensure compliance with tax regulations.

Maximizing Deductions:

Claiming valid business expenses reduces your tax bill and maximizes your business’s financial health. Keep meticulous records of receipts, invoices, and logbooks for at least seven years. Business expenses may include vehicle costs, rent, depreciation, interest, insurance premiums, and professional fees.

Checklist: Tax Filling Rates on Small Businesses

In New Zealand, there is a checklist of taxes and their standard fixed rates for small businesses. Here’s a brief overview:

- Income Tax: Small businesses in New Zealand are subject to income tax on their profits. The standard corporate tax rate is currently 28%, but there are different rates for different types of entities.

- Goods and Services Tax (GST): If your business earns more than $60,000 per year, you are required to register for GST. The current GST rate is 15%.

- Payroll Tax: There is no specific payroll tax in New Zealand, but employers are required to deduct Pay As You Earn (PAYE) tax from their employee’s wages and salaries.

- Provisional Tax: As mentioned earlier, if your tax bill exceeds $5,000, you are required to pay provisional tax in advance. This tax is payable in three installments throughout the year.

- Fringe Benefits Tax (FBT): If your business provides fringe benefits to employees, such as company cars or low-interest loans, you may be liable to pay FBT.

- ACC Levies: The Accident Compensation Corporation (ACC) provides accident insurance for all New Zealand residents and visitors. Employers are required to pay ACC levies based on their liable earnings.

- Local Government Rates: Depending on your business’s location and property ownership, you may be liable to pay local government rates.

- Import Duties and Excise Taxes: If your business imports goods into New Zealand or deals with excisable goods such as alcohol or tobacco, you may need to pay import duties or excise taxes.

Dos and Dont’s of Expense Claims:

Exercise caution when claiming expenses to avoid potential audits or penalties. Only claim legitimate business expenses and maintain clear documentation to substantiate your claims. Avoid claiming personal expenses or attempting to manipulate deductions, as this may lead to legal repercussions.

Frequently Asked Questions

What are the key tax deadlines for small businesses in New Zealand?

Most entities, from individuals to companies, have until July 7th after the end of the financial year to file their income tax returns. But if you’ve got an extension from the Inland Revenue Department (IRD) or a tax agent, you’ve got until March 31st of the following year.

Can I get a refund if my business operates at a loss?

Yes, business losses can be carried forward to offset future profits, and you may also be eligible for a refund Tax for small business owners on any overpaid provisional tax.

What should I do if I’m struggling to navigate the tax filing process?

If you’re feeling overwhelmed or confused, don’t hesitate to seek help from a professional Small business advisor, such as an accountant for small business or tax advisor. They can provide expert guidance tailored to your specific situation and help you navigate the process with ease.

Is it worth hiring an accountant to help with my taxes?

Absolutely! A qualified small business accountant can provide valuable guidance, ensure compliance with tax regulations, and potentially save you money by maximizing deductions and credits.

Conclusion:

Filing taxes for your small business in New Zealand doesn’t have to be a source of stress or confusion. By understanding your obligations, leveraging available resources, and maintaining meticulous records, you can navigate the tax with confidence and efficiency.

Should you require further assistance or clarification, don’t hesitate to seek guidance from qualified taxation professionals. Remember, proactive tax management is key to the financial success and sustainability of your business.